Editor's review

This is a tool that helps several option pricing tools.

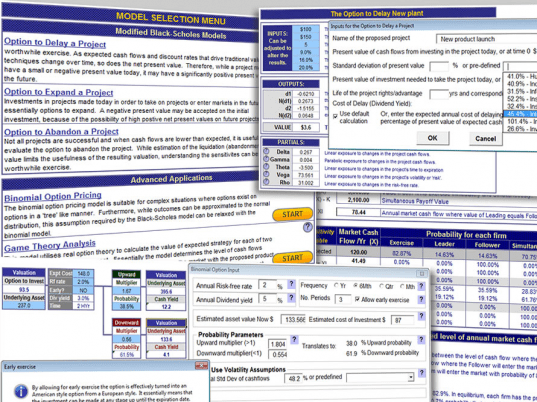

Real Option Valuation model covers a range of option pricing tools. It helps quantify the embedded strategic value for a range of financial analysis and investment scenarios. Traditionally, discounted cash flow analysis is used to determine if an option is right. However, this mode of analysis will give you an acceptable option only if, the returns on the project exceed the hurdle rate. This fails to consider a range of other strategic options that may be available with many investments. This tool provides several models that can quantify the options proposed. The model will also help identify what options might exist in your proposal. The software provides a “Quick Start” menu that will help which valuation model should be picked and how to interpret data provided by the model.

The tool assists you with information on each of the available models based on different theories. It also helps you in interpreting the results suggested by the theories. The theories considered in the program are three major ones. One is the modified Black Scholes option pricing model. This helps evaluate the options to delay, expand, or abandon investment projects. A second model is the Binomial option model. This creates unlimited binomial option branches. These can help evaluate complex strategic options available at many critical decision points. The third model available is the Nash equilibrium theory based on game theoretic underpinnings. This lets you model leader, follower and simultaneous market entry strategies in a competitive environment. The tool will also provide historical investment and/or industry risk profiles. The interface is well laid out but complex. But then this tool is not for amateurs but for specialists. This should prove to be a valuable tool for investments guidance.

User comments